(New York/Washington) The U.S. government has provided $750 million (approximately S$980 million) to help two domestic rare earth companies expand their rare earth magnet production capacity in an effort to catch up with China's global dominance.

The U.S. Department of Commerce announced on Monday (November 3) the signing of a non-binding preliminary letter of intent to allocate $50 million from the 2022 Chip Act to rare earth magnet manufacturer Vulcan Elements. This funding will be used to purchase equipment for producing permanent magnets, a key material used in fighter jets, wind turbines, and other essential products.

On the same day, North Carolina-based Vulcan Elements announced it had received a $620 million direct loan from the Office of Strategic Capital, under the U.S. Department of War, along with $550 million in private investment. This funding will be used to build a magnet factory with a capacity of 10,000 metric tons.

Vulcan Elements' partner, ReElement Technologies, also received $80 million each from the War Department's Office of Strategic Capital and private investors to expand its rare earth recycling and processing facilities.

The Pentagon confirmed the plan to the media, revealing that the two loans were funded by the "Big and Beautiful" tax and spending law signed in July of this year. This law authorizes the U.S. government to provide up to $100 billion in loans to promote the development of critical minerals and related industries.

Further Reading

According to Vulcan Elements, the $50 million from the Department of Commerce will be exchanged for equity of equivalent value in the company, while loans from the Department of War to the two companies will be issued as warrants, granting them the right to purchase company shares at a specific price.

In a statement, U.S. Commerce Secretary Rutnick said the latest U.S. government investment will accelerate the domestic production of rare earth magnets by U.S. manufacturers, adding, "We are precisely focused on bringing critical mineral and rare earth production back to the United States."

Beijing's strict controls on critical mineral exports at the end of last year exposed the vulnerability of U.S. manufacturing and defense industries to China's heavy reliance on supplies. Following the tariff war between the U.S. and China in April this year, China further tightened rare earth exports, driving a surge in demand for Vulcan Elements magnets, at which time it announced a $65 million funding round from venture capital funds.

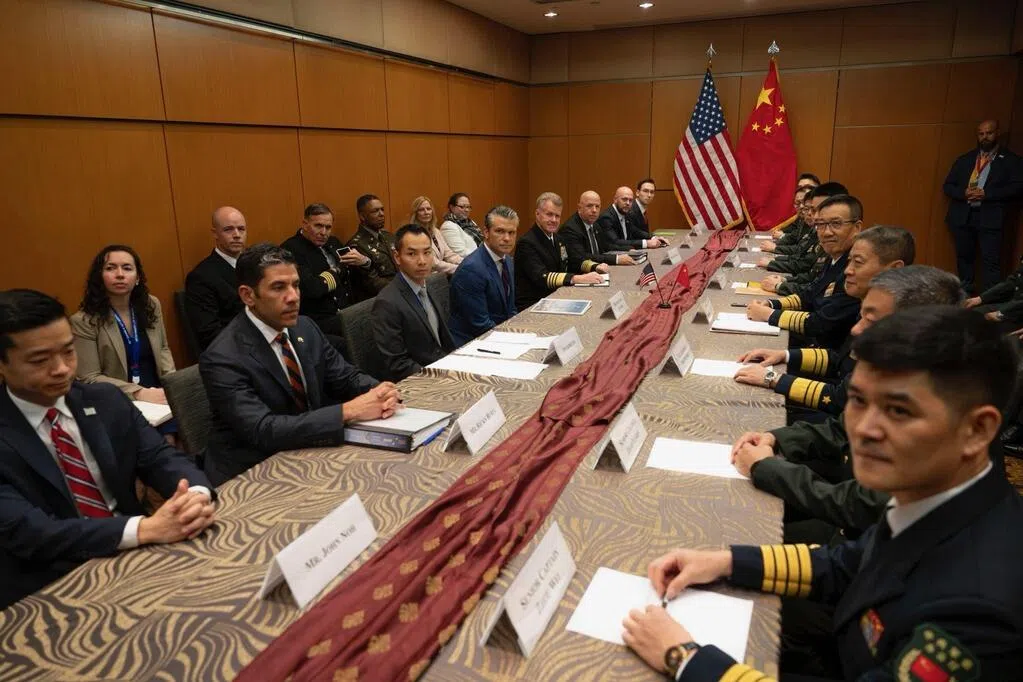

As U.S.-China negotiations entered a crucial stage, seeking an agreement before the Xi-Trump meeting at the end of October, China announced a series of export controls on rare earths and other critical minerals in October, once again shaking the global technology supply chain. However, after the meeting between the Chinese and U.S. leaders, China agreed to postpone the implementation of the new controls for one year.

This latest deal represents another move by the Trump administration to directly invest in the rare earth magnet supply chain in an effort to catch up with China's global dominance. It underscores the White House's determination to risk investing in building a rare earth magnet market outside of China, seeking to reduce the U.S. and its allies' dependence on China.

The deal also reflects the Trump administration's strategy of actively promoting the revival of the U.S. technology industry through equity investments in private companies. In July, the Pentagon acquired a 15% stake in MP Materials, the only rare earth miner in the U.S. In August, the Trump administration reached an agreement with chipmaker Intel to convert aid funds into a 10% equity stake.