(Washington, D.C.) U.S. Treasury Secretary Matt Bessant said the 43-day federal government shutdown caused $11 billion (approximately S$14.4 billion) in permanent damage to the U.S. economy, but he remains optimistic about U.S. economic growth next year given the decline in interest rates and the implementation of tax cuts.

In an interview with NBC on Sunday (November 23), Bessant pointed out that interest rate-sensitive sectors of the U.S. economy, such as the housing industry, have entered a recession, but he believes there is no immediate risk of the overall economy falling into negative growth.

He attributed inflation to the service-led economy, rather than President Trump's tariff policies on global trading partners. He added that falling energy prices will pull down overall prices more broadly.

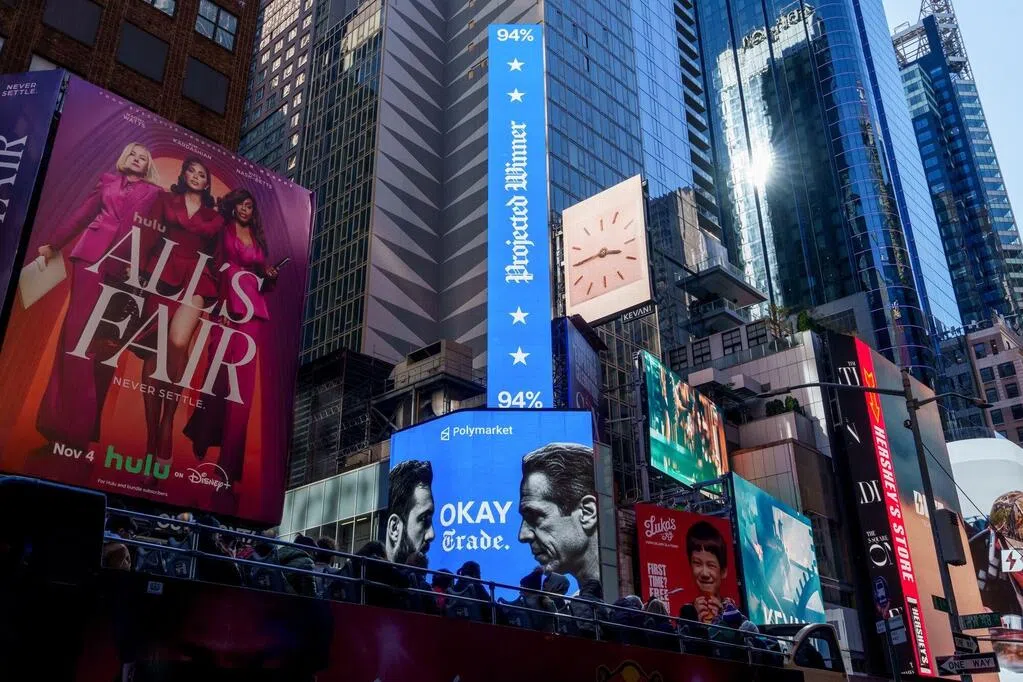

A recent Reuters/Ipsos poll showed Trump's approval rating had fallen to 38%, the lowest level since his return to the White House. With Democrats winning state and local elections in recent weeks, Trump has focused on the issue of "affordability."

Recent data shows that import tariffs have pushed up prices, dampened consumer demand, and led to a slowdown in U.S. manufacturing activity. A consumer survey released by the University of Michigan last Friday (21st) also showed that consumers are dissatisfied with rising prices. Despite this, Bessant remains optimistic. He said, "I am very, very optimistic about 2026. We have laid the foundation for strong, inflation-free economic growth."

Further Reading

Bessant noted that energy prices fell in October, while home sales rebounded. He said the government is continuing its efforts to reduce inflation. The current annual inflation rate in the United States is 3%.

Bessant also stated that inflation rates in Democratic-led states are 0.5% higher than in Republican-led states, attributing this difference to increased regulatory scrutiny in the former.

Bessant said the U.S. announcement last week of lowering import tariffs on food items such as bananas and coffee was a result of months of trade negotiations. “Inflation is a composite indicator, and we take all factors into account, working to keep prices within our control,” he said.

He pointed out that several policy adjustments will increase the real income of American workers, helping to offset the impact of rising living costs. These adjustments include setting a tax cap on overtime pay, reducing taxes on tipping income and certain Social Security benefits, and including auto loans in tax deductions. He added that taxpayers will receive substantial federal tax refunds in the first quarter of 2026 due to the tax rate adjustments.

Bessant also said the Trump administration plans to announce a measure this week aimed at reducing healthcare costs, but he did not provide details. He also pointed out that a series of trade agreements to be finalized in the future will boost the economy, and he expects new factories across the United States to gradually come online.

In an interview with Fox News, Hassett, director of the National Economic Council, also made an optimistic prediction for the U.S. economy. He said that although the longest government shutdown in U.S. history may cause a temporary economic slowdown in the fourth quarter of this year, he expects an absolute explosive growth in 2026.